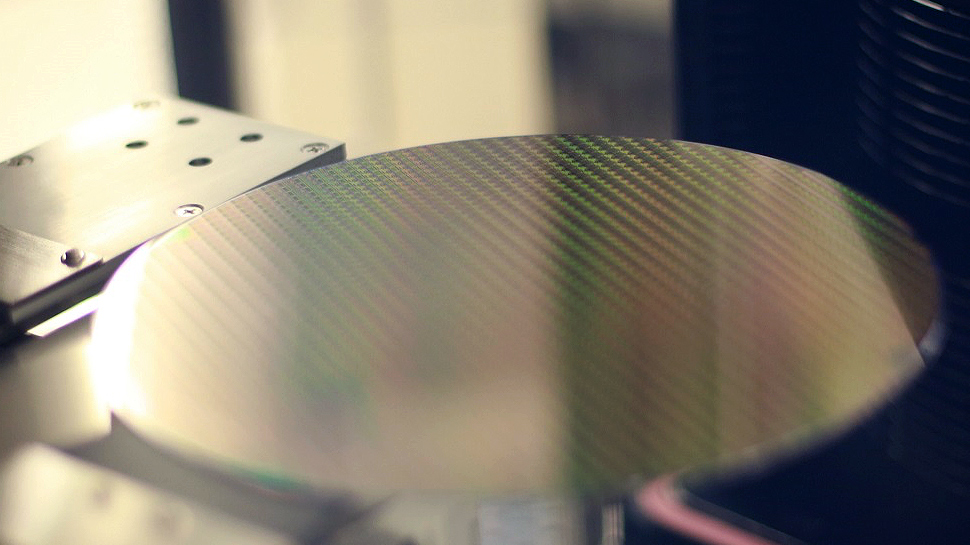

High-purity photoresist is critical for manufacturing wafers at advanced production nodes. As China strives to build a self-sufficient semiconductor industry, it will need to develop not only advanced wafer manufacturing tools but also high-purity photoresists. China has made significant progress in photoresist development in 2024, supported by government initiatives and growing demand from local wafer manufacturers, the report said TrendForce.

Semiconductor photoresists are classified by exposure wavelength, including broadband UV (300-450nm), g-line (436nm), i-line (365nm), KrF (248nm), ArF (193nm), EUV (13.5nm) and electron beam types. KrF, ArF and EUV photoresists are the purest and most advanced of them all. The global market is dominated by major players in Japan and the United States, such as JSR, Tokyo Chemical Industry, Shin-Etsu Chemical, Sumitomo Chemical, Fujifilm, and DuPont, who control most of the advanced photoresist technology.

Chinese companies including Shanghai Xinyang, Ruicheng and Bcpharma have made progress in entry-level photoresist, but have struggled to compete in the high-end market due to technical challenges and a late start. At present, China’s domestic penetration rate is still low: g-line and i-line photoresist is about 20%, KrF is less than 5%, and ArF is less than 1%. However, there are also Chinese companies making great strides in the direction of advanced photoresist.

Hubei Dinglong recently announced that its ArF and KrF photoresists passed customer evaluation and received orders from two domestic wafer manufacturers, totaling more than 1 million yen ($137,000). The company reportedly achieves this goal through processes such as customized monomer and resin structures, as well as enhanced purification and blending, thereby achieving a fully localized production process covering materials and final products.

Rongda Company received approval for a private placement of 244 million yuan (US$33.493 million) to provide funds for high-end photoresist projects, IC substrate solder mask and dry film projects. The funds will support research and development costs and operational needs. Rongda’s dry film products are mainly targeted at the PCB and semiconductor industries, which are experiencing strong growth due to the increase in production capacity in China.

China’s rapidly expanding microelectronics manufacturing base has increased demand for localized photoresist solutions as new wafer fabs come online. The Chinese government actively supports the semiconductor and raw material industries through policies to encourage domestic innovation and reduce dependence on foreign suppliers.

Although challenges posed by high-tech barriers brought about by global competition still exist, China’s photoresist industry is gradually narrowing the gap, which is expected to eventually expand the market share of these companies in high-end applications.