Four hundred years ago, on New Year’s Day 1624, ice on the Lech River in the Netherlands broke through an embankment outside Utrecht. For a country that’s about a third below sea level, that’s a pretty big problem.

Soon the area was flooded and even Amsterdam was threatened by the water. Locals eventually managed to stem the floods, but they still need comprehensive, lasting reconstruction – which will be extremely expensive.

Fortunately, the Dutch were a talented and experienced financial pioneer and developed the most active bond market of the era. The local water authority, called Hoogheemraadschap Lekdijk Bovendams, quickly sold more than 50 bonds to raise approximately 23,000 Karolus to fund the restoration work.

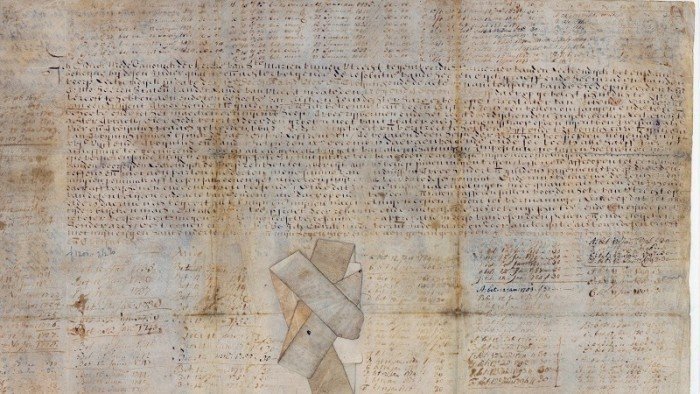

The only surviving bond of these bonds is a 1,200 guilder bond sold on 10 December 1624 to a wealthy lady in Amsterdam named Elsken Jorisdochter. In return for her money, the water board promised Jorisdochter, her descendants or anyone else who owned the bearer bonds 2.5 percent interest in perpetuity.

It is worth noting that the bond is still valid and pays interest of €13.61 per year. Yesterday, the bond’s current owner – the New York Stock Exchange – collected £299.42 in interest arrears on the bond’s 400th birthday, an event FT Alphaville was also lucky enough to attend.

Astute readers will remember that FTAV wrote something about Surviving Dutch Permanent Currency last year. So why are we arguing about this again?

Partly because this bond is a vivid reminder of how fixed-income markets structured the modern world, it’s worth repeating. Bonds have won wars and broken nations. They funded hospitals, tobacco farms where slaves worked, and sugar plantations. They are now funding data centers and chips that power artificial intelligence, as well as more obvious duds like Manchester United.

It is therefore likely that more than half of global debt is in the form of bonds rather than loans (comprehensive and accurate global data on this is incomplete). This is a big deal, As MainFT explained in a magazine article last year.

To give one example, the largest lenders in the United States are no longer banks; This is BlackRock. Here’s a look at how several large banks and asset managers rank by how much they lend in the form of bonds or loans.

But most of the time we keep talking about it because that’s what it is obviously Amazing. The 1624 bonds were a financial miracle of the world. If you don’t like a Dutch goatskin perpetual contract that’s four centuries old and still pays interest, then I’m afraid we can’t be friends.

With that in mind, here are some more details about the origins of the world’s oldest living bond, and the 400th birthday celebrations on Tuesday – we even got a pretty little cake decorated with the issuer’s original crest.

The first thing to understand is that water authorities like Hoogheemraadschap Lekdijk Bovendams are die-hards.

After all, in Europe’s flooded lowlands – the Netherlands is sometimes called the swamp of Europe – they are a matter of life and death. Not just for you, your family and your community, but also for neighboring villages or towns.

According to the writings of William Goetzmann and Geert Rouwenhorst, in 1323 a Dutch count sent his troops to burn a town as punishment for not making necessary repairs to the dikes . origin of value. Until the 19th century, water authorities enjoyed The legal right to punish local slackersincluding branding, whipping, exile and execution. The Rhineland Water Board even had its own gallows and a whip post next to one of the dikes, which sent a very powerful signal.

They also take debt repayment just as seriously. Hoogheemraadschap Lekdijk Bovendams no longer exists, but its modern descendant is Hoogheemraadschap De Stichtse Rijnlanden, based outside Utrecht. The original bonds were signed on 10 December 1624 in a building that is now part of Utrecht University, which hosted the event in the same building yesterday.

Most of the bonds issued by Lekdijk Bovendams were eventually bought back – they can be redeemed at any time at the water board’s discretion – while others have been hemorrhaging over the years. But De Stichtse Rijnlanden still provides services seven Of these Methuselah bonds, the 1624 bond is the oldest.

Pictured are bonds,”elongateAs the backs of the bonds were full, individual payments were recorded and De Stichtse Rijnlanden took the hard currency out of the box.

This is what the bond itself says, translated from Old Dutch. Rich in content, yet much more concise than most bond prospectuses today.

I, Didirck Mode, canon of St. Mary’s Church in Utrecht, now treasurer of the Bovendan family of Lekendike, do hereby declare that by the Governor and Board of the Gentlemen of Lekendike on December 16, 1624 The decision taken on 9 December and the subsequent deed granted by the Executive Committee of the Province of Utrecht on 9 December owed the estate of the Province of Utrecht to and had been sold to Elsken Jorisdochter, her heirs or any person with a claim , and sold for the benefit of $1,200 I declare to have received in full the Carolus shield from the said Elsken Jorisdochter for the erection of a new quay, two willow revetments, and a straight new embankment extending to Ti The damaged Lake Dike outside Irvine, God willing, broke because of very high water strength and drifting ice on New Year’s Day 1624.

[I also declare] Granted and given annually 75 Carolus guilders, 20 stivers each as a heritable annuity, one half of the said annuity being paid on the 9th of June, 1625, and the other half on the 9th of December following, every six Payments are made monthly until all payments are repaid completely free of any taxes, levies or encumbrances of any name or title, without exception.

Under these conditions, I or my successor [unreadable] The shareholders of the said Lekendijk may, at any time we so wish, extinguish, repay and repurchase the said annuity in one lump sum and not in part or in fractions, in the amount of the said twelve hundred Carolus guilders, not one penny less . Court of Utrecht or elsewhere, if necessary at my or my successor’s immediate expense.

In order to make it always clear that everything written here has been affected by the above decision and authorization, and in order that all parties can be better reassured, this decision and approval will be written on the reverse side of this document and signed without reservation. To this end I, the aforesaid Didik Maude, with the above duties and authority, have signed this document with my own hand, this 10th day of December, 1624, and have affixed my seal thereunder.

The 1624 bonds ended up in the hands of the New York Stock Exchange, thanks to Dutch-American banker Albert Andriesse, a senior partner at Pierson & Co. and a member of the Amsterdam Stock Exchange. Member of the Board of Directors (Amsterdam Stock Exchange).

Andriesse bought the permanent gem at auction as a historical antique and donated it to the New York Stock Exchange during a visit to New York in 1938 as a gesture of friendship since the city established it in 1624 It was founded in 1999 as New Amsterdam.

Two years later, Andries and his family fled the Netherlands to escape the Nazis and settled in New York in 1941.

Even at the time, his gift was novel enough to receive a brief mention in the New York Times, and the following clip comes courtesy of his granddaughter, who attended yesterday’s interest payment ceremony.

Please take a moment to consider how this connection survived.

The borders of the country now known as the Netherlands have changed dramatically over the years. There have been many revolutions, several epidemics, four different currencies and countless wars. For a time Napoleon completely annexed the country.

Throughout it all, it has been paying interest — albeit with some huge gaps at times (the NYSE last charged interest in 2004).

Restoration efforts it funded also remain, although they are obscured by natural erosion.

The interest was received on behalf of the New York Stock Exchange by Peter Asch and David D’Onofrio, archivists at the New York Stock Exchange, but was immediately donated to the local Levee Museum, which we later visited. But we can’t help but want to find the effective yield on bonds.

It was apparently a gift to the New York Stock Exchange, but Ash revealed that it was used for insurance purposes several years ago and was worth $35,000. So that means 4.1 basis points per year. Ke Qing.